Rory Ritrievi | Source | President and CEO at Mid Penn Bank

Rory Ritrievi

Rory G. Ritrievi joined Mid Penn Bank and parent company Mid Penn Bancorp, Inc. in 2009 as President and Chief Executive Officer. Prior to joining Mid Penn, Mr. Ritrievi served as Market President and Chief Lending Officer of Commerce Bank/Harrisburg. Mr. Ritrievi has over 35 years of experience in the financial services industry and is a licensed, but non-practicing attorney in the state of Pennsylvania. He currently serves on the Advisory Board for Widener Law Commonwealth’s Business Advising Certificate Program and on the Board of Directors of the Harrisburg Area YMCA and is an active member of his community. Mr. Ritrievi holds a Juris Doctor from Widener University School of Law and a Bachelor’s Degree in Economics from the University of Pittsburgh.

-

Mid Penn Bank

President and CEO

-

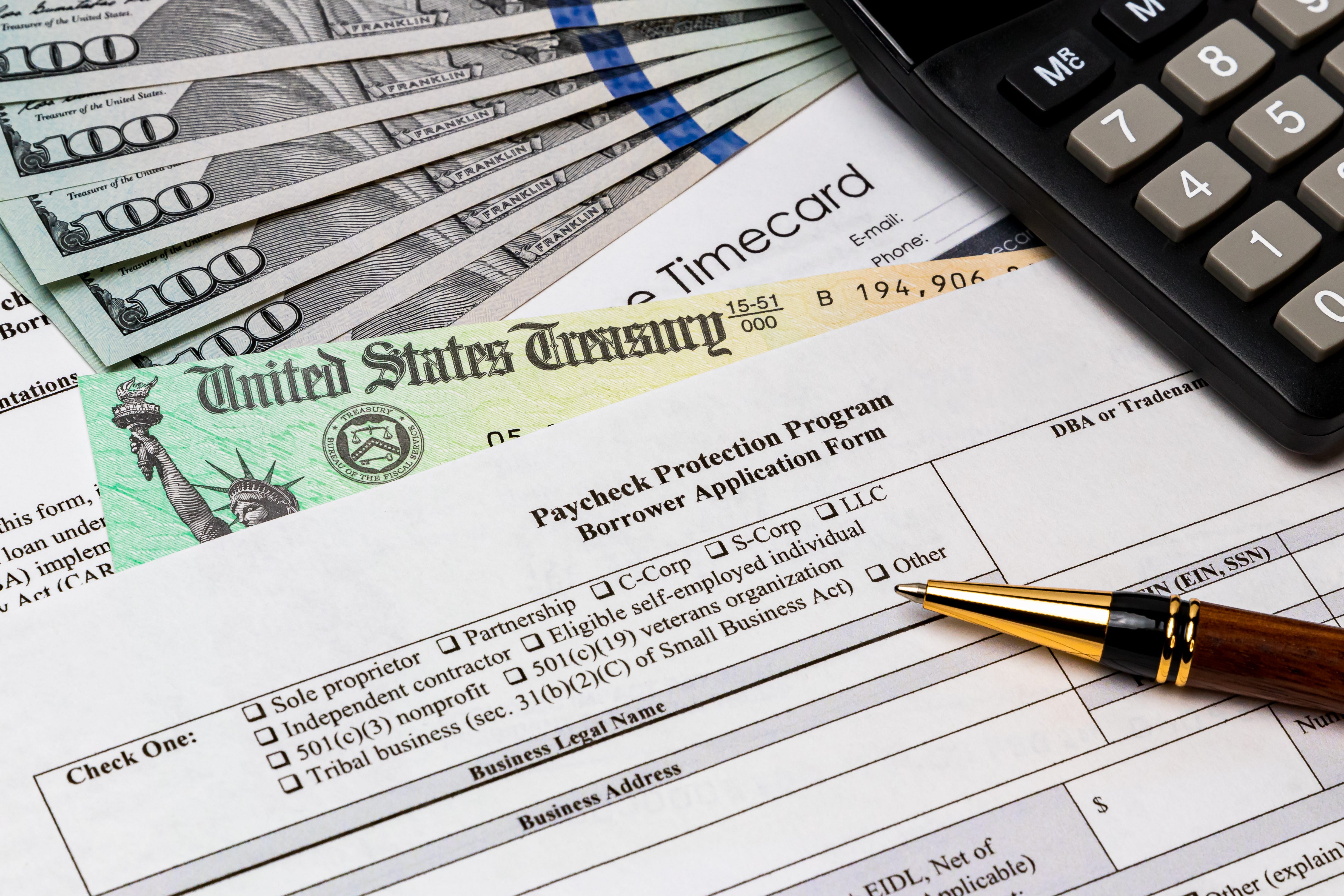

‘Incredible feeling’ as small businesses take advantage of PPP loan head start

On February 26, a two-week window opened up for small businesses — with 20 employees or less — to apply for the latest round of Paycheck Protection Program loans before the rest of the businesses can apply. Read more here.

Article -

Mid Penn Bank begins rebranding effort for First Priority Bank Division offices and branches

MILLERSBURG — Mid Penn Bank has launched a rebranding effort for branches and offices in its First Priority Bank Division.

Article -

Mid Penn Bank to Rebrand Offices in First Priority Bank Division

MILLERSBURG, Pa., Feb. 11, 2021 (GLOBE NEWSWIRE) -- Mid Penn Bancorp, Inc. (“Mid Penn”) (NASDAQ:MPB), parent company of the wholly-owned subsidiaries Mid...

Article

-

We continue to see applications from micro, small and medium-sized business flow in at a steady pace. We welcome the opportunity to help these smaller companies for this two-week period, but will be at the ready for any larger PPP borrowers temporarily sidelined by this announcement.

-

In the first round of PPP, when we originated over 4,100 PPP loans for small businesses throughout our footprint that desperately needed the funds to protect the paychecks of over 55,000 community members, we established a process and reputation for providing a world-class PPP customer experience. Now, four weeks into the second round of PPP, with refinements to the process that make applying even easier, we again are experiencing tremendous success. The majority of our PPP borrowers in 2021 had received a 2020 PPP loan from us, but we are also adding new-to-us borrowers as a result of the reputation we built in that first round. We are excited with these results as we have already originated over 2,000 round 2 loans while protecting another 25,000 plus paychecks.

-

In the first round of PPP, when we originated over 4,100 PPP loans for small businesses throughout our footprint that desperately needed the funds to protect the paychecks of over 55,000 community members, we established a process and reputation for providing a world class PPP customer experience. Now, four weeks into the second round of PPP, with refinements to the process that make applying even easier, we again are experiencing tremendous success. The majority of our PPP borrowers in 2021 had received a 2020 PPP loan from us but we are also adding new-to-us borrowers as a result of the reputation we built in that first round. We are excited with these results as we have already originated over 2,000 round 2 loans while protecting another 25,000+ paychecks.