BT

Brad Thomas

seekingalpha.com

Covers

Publications

- seekingalpha.com132 articles

- Forbes7 articles

- eater.com1 article

- The Daily Beast1 article

Writes Most On

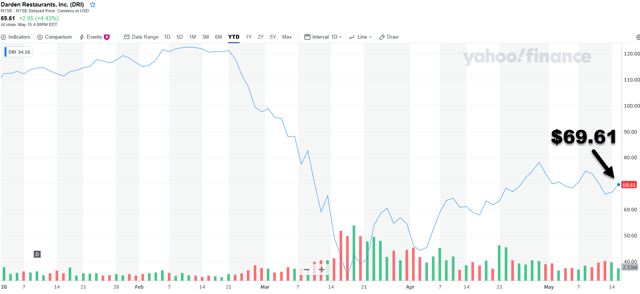

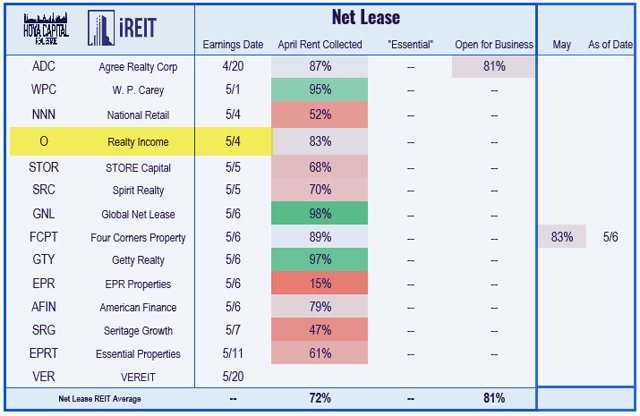

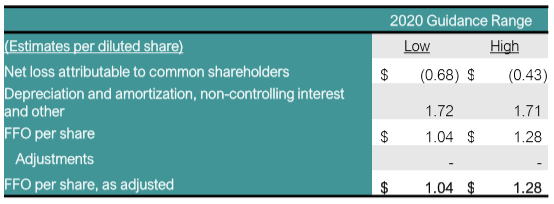

A Tasty 6.4% Dividend Yield For Four Corners Property Trust20 May 2020—seekingalpha.comSummary We recognized that Darden and FCPT were both strong enterprises. FCPT has proven to be a terrific pick this far for our Cash Is King Portfolio, up 41.6% since our investment on March 23, 2020. We maintain a Strong Buy, recognizing the clarity we have now. Looking for a portfolio of ideas like this one? Members of iREIT on Alpha get exclusive access to our model portfolio. Get started today » In a Barron’s article published earlier this month, Ed Lin explained that insiders at Darden...

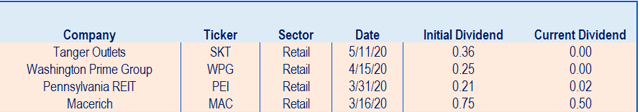

A Tasty 6.4% Dividend Yield For Four Corners Property Trust20 May 2020—seekingalpha.comSummary We recognized that Darden and FCPT were both strong enterprises. FCPT has proven to be a terrific pick this far for our Cash Is King Portfolio, up 41.6% since our investment on March 23, 2020. We maintain a Strong Buy, recognizing the clarity we have now. Looking for a portfolio of ideas like this one? Members of iREIT on Alpha get exclusive access to our model portfolio. Get started today » In a Barron’s article published earlier this month, Ed Lin explained that insiders at Darden... Tanger: A Former SWAN Looks To Rise Above The Ashes21 May 2020—seekingalpha.comSummary The coronavirus pandemic has challenged a number of REITs. My recommendations are based on the best data available, independent of past positions on a stock, as bias is something no one can afford. I’m keeping my personal shares in Tanger, which is now less than 3% of my REIT portfolio. I suppose I’m willing to take the risk on myself to see this phoenix rise from what are at this point still-smoldering ashes. This idea was discussed in more depth with members of my private investing...

Tanger: A Former SWAN Looks To Rise Above The Ashes21 May 2020—seekingalpha.comSummary The coronavirus pandemic has challenged a number of REITs. My recommendations are based on the best data available, independent of past positions on a stock, as bias is something no one can afford. I’m keeping my personal shares in Tanger, which is now less than 3% of my REIT portfolio. I suppose I’m willing to take the risk on myself to see this phoenix rise from what are at this point still-smoldering ashes. This idea was discussed in more depth with members of my private investing... Pennsylvania REIT: Selling Planks To Plug A Leaky Ship23 May 2020—seekingalpha.comSummary We can learn a tremendous amount from struggling companies. Understanding why a company finds itself in a distressed position can help us avoid problematic situations in the future. This type of evaluation also augments our analytical and investing skills. This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today » This article was coproduced with Williams Equity Research. As we walk through the situation Pennsylvania REIT...

Pennsylvania REIT: Selling Planks To Plug A Leaky Ship23 May 2020—seekingalpha.comSummary We can learn a tremendous amount from struggling companies. Understanding why a company finds itself in a distressed position can help us avoid problematic situations in the future. This type of evaluation also augments our analytical and investing skills. This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today » This article was coproduced with Williams Equity Research. As we walk through the situation Pennsylvania REIT... Quality Matters: Who's Buying These A-Rated REITs?26 May 2020—seekingalpha.comSummary Any company can look good in a bull market, but when the tide goes out, speculators take the most losses. A strong balance sheet is a good indicator of endurance and the company’s long-term survival, and one of the most important aspects of the balance sheet is liquidity. One of the most persuasive tests of high-quality is an uninterrupted record of dividend payments going back over many years. Looking for a portfolio of ideas like this one? Members of iREIT on Alpha get exclusive...

Quality Matters: Who's Buying These A-Rated REITs?26 May 2020—seekingalpha.comSummary Any company can look good in a bull market, but when the tide goes out, speculators take the most losses. A strong balance sheet is a good indicator of endurance and the company’s long-term survival, and one of the most important aspects of the balance sheet is liquidity. One of the most persuasive tests of high-quality is an uninterrupted record of dividend payments going back over many years. Looking for a portfolio of ideas like this one? Members of iREIT on Alpha get exclusive... It's A Bird, It's A Plane, It's Brookfield Property REIT27 May 2020—seekingalpha.comSummary Although BPY/BPR is considered a mall REIT, the company technically is considered a diversified REIT because it invests in core office, retail and multifamily properties. It's important to clarify the difference between BPY (which is an LP that uses a K-1 tax form) and BPR, which is a REIT. I’m UPGRADING BPY/BPR to a Strong Spec Buy (was Spec Buy) recognizing that this REIT deserves to be upgraded to first class. This idea was discussed in more depth with members of my private...

It's A Bird, It's A Plane, It's Brookfield Property REIT27 May 2020—seekingalpha.comSummary Although BPY/BPR is considered a mall REIT, the company technically is considered a diversified REIT because it invests in core office, retail and multifamily properties. It's important to clarify the difference between BPY (which is an LP that uses a K-1 tax form) and BPR, which is a REIT. I’m UPGRADING BPY/BPR to a Strong Spec Buy (was Spec Buy) recognizing that this REIT deserves to be upgraded to first class. This idea was discussed in more depth with members of my private...

People Also Viewed

- BCkiplinger.com

usatoday.com

usatoday.com- BOForbes