CR

Claire Ruckin

Reuters

- London, England, United Kingdom

Covers

Publications

- Reuters3 articles

- Bloomberg1 article

Writes Most On

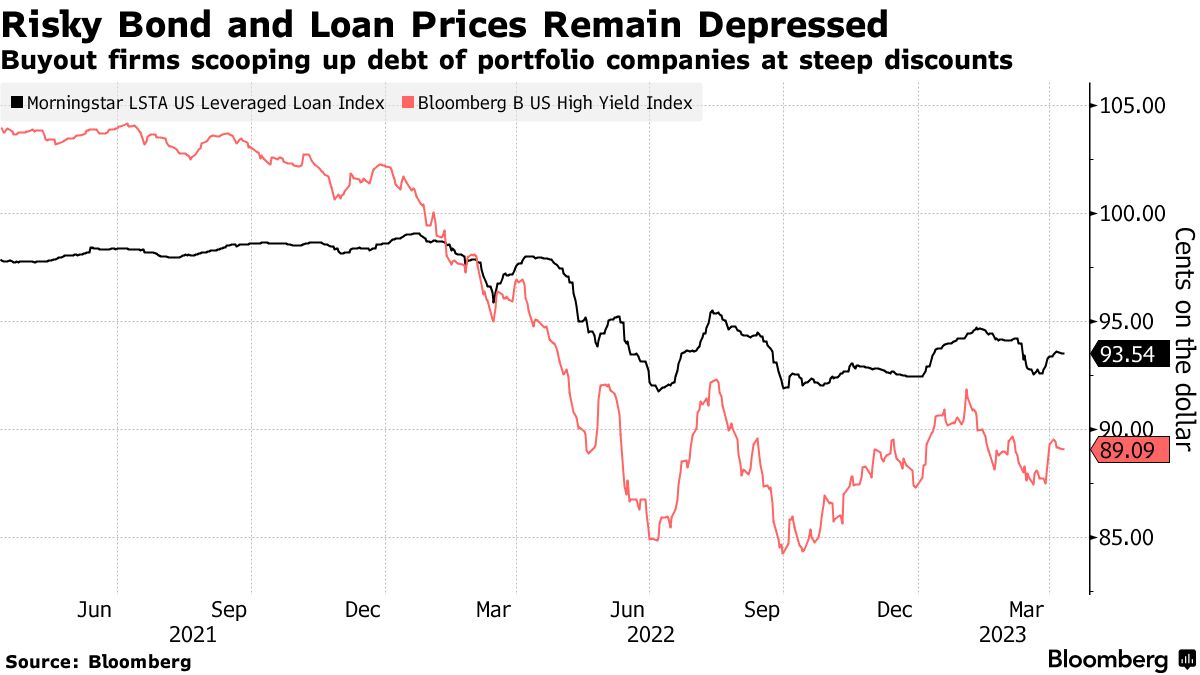

Private Equity’s Latest Money-Making Trade: Buying Its Own Debt12 Apr 2023—BloombergSome of the world’s top private equity firms are scooping up the debt of their own portfolio companies from banks at steep discounts as they seek juicy returns amid a lull in deal making. Advent International Corp. recently bought a portion of a loan that helped fund its buyout of a Royal DSM unit, while Clayton Dubilier & Rice has purchased debt supporting at least two of its deals over the past year. Just last week Elliott Investment Management snapped up a $550 million chunk of bonds...

Private Equity’s Latest Money-Making Trade: Buying Its Own Debt12 Apr 2023—BloombergSome of the world’s top private equity firms are scooping up the debt of their own portfolio companies from banks at steep discounts as they seek juicy returns amid a lull in deal making. Advent International Corp. recently bought a portion of a loan that helped fund its buyout of a Royal DSM unit, while Clayton Dubilier & Rice has purchased debt supporting at least two of its deals over the past year. Just last week Elliott Investment Management snapped up a $550 million chunk of bonds... UPDATE 1-Private equity firms take dividends as downturn looms16 Apr 2019—Reuters(Adds quote from Ceva) LONDON, April 16 (LPC) - European private equity sponsors are increasingly looking to raise leveraged loans for dividend payouts in order to realise gains, while also locking in debt in preparation for a potential market downturn. With volume in Europe’s leveraged loan market at its lowest level since 2009, bankers are aggressively pitching dividend recaps to sponsors in an attempt to boost deal flow. Two dividend deals cleared the market in as many weeks - for French...

UPDATE 1-Private equity firms take dividends as downturn looms16 Apr 2019—Reuters(Adds quote from Ceva) LONDON, April 16 (LPC) - European private equity sponsors are increasingly looking to raise leveraged loans for dividend payouts in order to realise gains, while also locking in debt in preparation for a potential market downturn. With volume in Europe’s leveraged loan market at its lowest level since 2009, bankers are aggressively pitching dividend recaps to sponsors in an attempt to boost deal flow. Two dividend deals cleared the market in as many weeks - for French... Private equity firms take dividends as downturn looms9 Apr 2019—ReutersLONDON, April 9 (LPC) - European private equity sponsors are increasingly looking to raise leveraged loans for dividend payouts in order to realise gains, while also locking in debt in preparation for a potential market downturn. With volume in Europe’s leveraged loan market at its lowest level since 2009, bankers are aggressively pitching dividend recaps to sponsors in an attempt to boost deal flow. Two dividend deals cleared the market in as many weeks - for French veterinary...

Private equity firms take dividends as downturn looms9 Apr 2019—ReutersLONDON, April 9 (LPC) - European private equity sponsors are increasingly looking to raise leveraged loans for dividend payouts in order to realise gains, while also locking in debt in preparation for a potential market downturn. With volume in Europe’s leveraged loan market at its lowest level since 2009, bankers are aggressively pitching dividend recaps to sponsors in an attempt to boost deal flow. Two dividend deals cleared the market in as many weeks - for French veterinary...- LPC: Private equity firms call the shots with portable loans20 Jul 2017—ReutersLONDON (Reuters) - Four ‘portable’ leveraged loans have hit the European leveraged loan market in recent weeks as private equity firms put pressure on banks to allow loans to stay in place when companies are sold, reducing the need for new financings. Portability has been a regular feature of the high yield bond market for some time, but is rarely seen in the loan market, where the sale of a company and subsequent change of ownership usually triggers a loan repayment and a new deal. By making...

People Also Viewed

Evening News Editor at The Wall Street Journal

Evening News Editor at The Wall Street Journal ifre.com

ifre.com