DJ

Dewi John

ipe.com

- Tacoma, Washington, United States

Covers

Publications

- ipe.com7 articles

Writes Most On

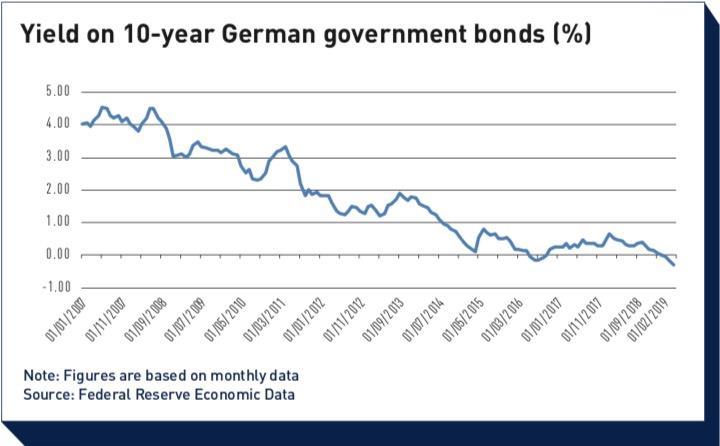

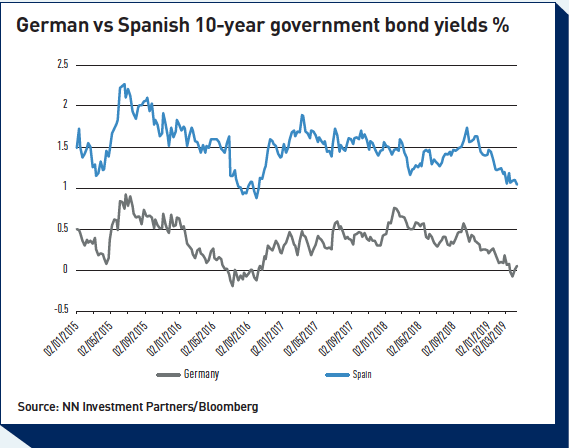

Government Bonds - Euro-zone: Turning Japanese14 Jun 2019—ipe.comThe euro-zone appears to be in a low-growth liquidity trap redolent of Japan Key points Low euro-zone growth and inflation, reinforced by European Central Bank (ECB) policy, are set to keep core sovereign bond yields low for the foreseeable future Central bankers navigate the dangers of pain now or later in applying monetary stimulus A positively sloping yield curve presents resents relative value opportunities compared with other currencies Issuance from Italy and Spain offers better yield...

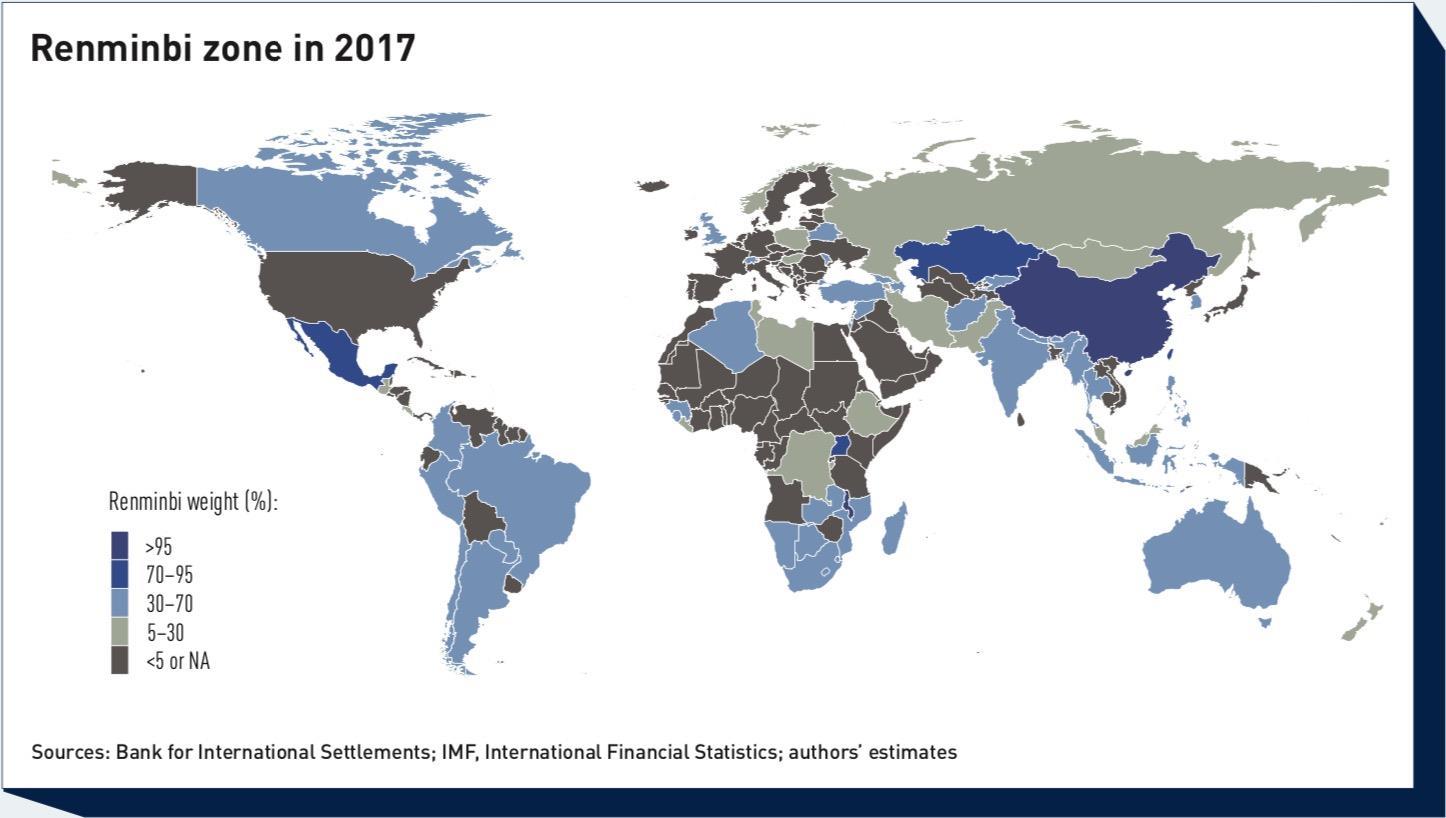

Government Bonds - Euro-zone: Turning Japanese14 Jun 2019—ipe.comThe euro-zone appears to be in a low-growth liquidity trap redolent of Japan Key points Low euro-zone growth and inflation, reinforced by European Central Bank (ECB) policy, are set to keep core sovereign bond yields low for the foreseeable future Central bankers navigate the dangers of pain now or later in applying monetary stimulus A positively sloping yield curve presents resents relative value opportunities compared with other currencies Issuance from Italy and Spain offers better yield...- Trade war: The silver lining in the clouds of trade war14 Sep 2019—ipe.comSmaller emerging market players could benefit from the US-China trade war Key points The trade war between the US and China is speeding up the trend for lower-value industries to relocate from China to countries with lower wage costs Tech and electronics companies are also shifting operations from China to Vietnam, Taiwan and elsewhere Commodity suppliers to China, such as Peru, Chile and Australia, will likely be adversely affected While the immediate effects on EMs are generally positive if...

- Briefing: The cliff-hanger of European banks14 Sep 2019—ipe.comEuropean banks are not looking good, with Deutsche Bank’s miseries being the most high-profile. Indeed, it has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs. Deutsche Bank’s restructuring indicates the troubled position of European banks Likely rate cuts by the European Central Bank (ECB) will further reduce bank margins Do European financials pose a systemic threat to the global economy in a way that harks back to the last time it...

- Artificial Intelligence: Solving the riddle with AI14 Nov 2019—ipe.comArtificial intelligence is making it possible to glean better ESG information about companies Key points ESG investors have few standard metrics on which to base their decisions Data gaps can be filled by using AI to crawl a variety of media for defined information – from Twitter accounts to satellite picures Whether obtained through voluntary disclosure or from third parties, any such data contains biases and needs reinterpretation How can factor investors quantify the factors they consider...

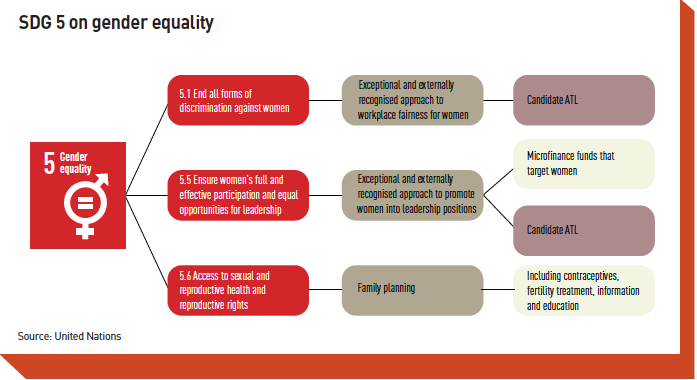

SDI Asset Owner Platform: ESG investing gets a platform lift14 Nov 2019—ipe.comTwo Dutch pension providers have launched a global platform to help asset owners invest in line with the UN’s Sustainable Development Goals Dutch institutional investors have announced the launch of a global platform to guide and standardise ESG investments, supported by artificial intelligence (AI). The joint initiative by two of the largest Dutch pension providers – APG and PGGM – is called the SDI Asset Owner Platform. It aims to help asset owners invest in line with the UN’s Sustainable...

SDI Asset Owner Platform: ESG investing gets a platform lift14 Nov 2019—ipe.comTwo Dutch pension providers have launched a global platform to help asset owners invest in line with the UN’s Sustainable Development Goals Dutch institutional investors have announced the launch of a global platform to guide and standardise ESG investments, supported by artificial intelligence (AI). The joint initiative by two of the largest Dutch pension providers – APG and PGGM – is called the SDI Asset Owner Platform. It aims to help asset owners invest in line with the UN’s Sustainable...

People Also Viewed

European Finance and Banking Reporter at The Wall Street Journal

European Finance and Banking Reporter at The Wall Street Journal- BCkiplinger.com