NK

Narae Kim

moneyweb.co.za

- New York, New York, United States

Covers

Publications

- Bloomberg20 articles

- bloombergquint.com7 articles

- yahoo.com3 articles

- japantimes.co.jp2 articles

- The Independent1 article

- taipeitimes.com1 article

- gazette.com1 article

Writes Most On

Japanese and South Korean investors plow cash into structured products29 Mar 2017—japantimes.co.jpHONG KONG – Yield-starved Japanese investors are taking out the cash stashed under the futon and plowing it into potentially risky securities. Faced with domestic bond yields below zero and a rally in global equities that only recently had some wobbles, domestic retail investors drove sales of bonds tied to the Nikkei 225 stock average to the highest in at least three years in January, according to Societe Generale SA. This marks a comeback for the so-called uridashi notes, offerings of which...

Japanese and South Korean investors plow cash into structured products29 Mar 2017—japantimes.co.jpHONG KONG – Yield-starved Japanese investors are taking out the cash stashed under the futon and plowing it into potentially risky securities. Faced with domestic bond yields below zero and a rally in global equities that only recently had some wobbles, domestic retail investors drove sales of bonds tied to the Nikkei 225 stock average to the highest in at least three years in January, according to Societe Generale SA. This marks a comeback for the so-called uridashi notes, offerings of which... Japanese, South Korean investors plow cash into structured products29 Mar 2017—japantimes.co.jpHONG KONG - Yield-starved Japanese investors are taking out the cash stashed under the futon and plowing it into potentially risky securities. Faced with domestic bond yields below zero and a rally in global equities that only recently had some wobbles, domestic retail investors drove sales of bonds tied to the Nikkei 225 stock average to the highest in at least three years in January, according to Societe Generale SA. This marks a comeback for the so-called uridashi notes, offerings of which...

Japanese, South Korean investors plow cash into structured products29 Mar 2017—japantimes.co.jpHONG KONG - Yield-starved Japanese investors are taking out the cash stashed under the futon and plowing it into potentially risky securities. Faced with domestic bond yields below zero and a rally in global equities that only recently had some wobbles, domestic retail investors drove sales of bonds tied to the Nikkei 225 stock average to the highest in at least three years in January, according to Societe Generale SA. This marks a comeback for the so-called uridashi notes, offerings of which... The Dollar Bond Party Comes to Frontier Markets29 Mar 2017—BloombergPapua New Guinea plans $500m 5-year debt sale later this year Spreads on Asian junk bonds are near lowest since 2013 Talk about risk-on: the demand for higher-yielding securities is proving so strong that Papua New Guinea, one of Asia’s poorest nations, is contemplating a debut issue of dollar bonds. The southwest Pacific nation plans to raise $500 million in five-year bonds, central bank governor Loi Martin Bakani said Tuesday at the Credit Suisse Asian Investment Conference in Hong Kong....

The Dollar Bond Party Comes to Frontier Markets29 Mar 2017—BloombergPapua New Guinea plans $500m 5-year debt sale later this year Spreads on Asian junk bonds are near lowest since 2013 Talk about risk-on: the demand for higher-yielding securities is proving so strong that Papua New Guinea, one of Asia’s poorest nations, is contemplating a debut issue of dollar bonds. The southwest Pacific nation plans to raise $500 million in five-year bonds, central bank governor Loi Martin Bakani said Tuesday at the Credit Suisse Asian Investment Conference in Hong Kong.... Chinese Brokers Are Muscling in on Asia's Junk Bond Underwriters5 Apr 2017—BloombergChina’s brokerages are out-muscling global investment banks to win more underwriting business in Asia’s junk bond market amid record offerings, as they increasingly help borrowers from the nation raise foreign currency debt. Haitong Securities Co. topped the league table for high-yield notes denominated in dollars, euro and yen from companies in Asia excluding Japan in the first quarter, according to data compiled by Bloomberg. China Merchants Securities Co. moved up four places to fifth....

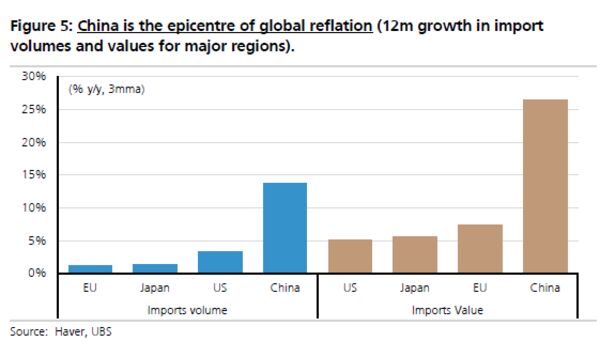

Chinese Brokers Are Muscling in on Asia's Junk Bond Underwriters5 Apr 2017—BloombergChina’s brokerages are out-muscling global investment banks to win more underwriting business in Asia’s junk bond market amid record offerings, as they increasingly help borrowers from the nation raise foreign currency debt. Haitong Securities Co. topped the league table for high-yield notes denominated in dollars, euro and yen from companies in Asia excluding Japan in the first quarter, according to data compiled by Bloomberg. China Merchants Securities Co. moved up four places to fifth.... Here's Why the Global Reflation Trade Might Be Over12 Apr 2017—BloombergThe softening in China's inflation momentum suggests the best days of the global reflation rally might be behind us. China has been the central growth driver for the world economy, even though the U.S. became the "flag-bearer of the reflation trade" in the fourth quarter, UBS AG strategists Bhanu Baweja and Manik Narain said. "To a degree, political change in the U.S. stole China's reflationary thunder," they wrote in a note to clients, as real rates and inflation expectations led a global...

Here's Why the Global Reflation Trade Might Be Over12 Apr 2017—BloombergThe softening in China's inflation momentum suggests the best days of the global reflation rally might be behind us. China has been the central growth driver for the world economy, even though the U.S. became the "flag-bearer of the reflation trade" in the fourth quarter, UBS AG strategists Bhanu Baweja and Manik Narain said. "To a degree, political change in the U.S. stole China's reflationary thunder," they wrote in a note to clients, as real rates and inflation expectations led a global...

People Also Viewed