Paige Smith

Finance Reporter at Bloomberg

- Washington, DC, USA

- in/paigehamiltonsmith/

Covers

Publications

- Bloomberg19 articles

- Fortune1 article

- yahoo.com1 article

- Bloomberg Law

- Bloomberg

Writes Most On

Average Payments for New Home Loans Rose 46% in 2022, CFPB Finds27 Sep 2023—BloombergThe average monthly payment for new mortgages increased 46% in 2022 as interest rate hikes squeezed US home borrowers, according to the Consumer Financial Protection Bureau. Payments on conventional 30-year fixed-rate mortgages increased to $2,045 in December 2022 from $1,400 a year earlier, the CFPB said Wednesday in a report. The consumer watchdog annually collects and analyzes data under the Home Mortgage Disclosure Act, also known as HMDA. The trends are expected to persist this year,...

Average Payments for New Home Loans Rose 46% in 2022, CFPB Finds27 Sep 2023—BloombergThe average monthly payment for new mortgages increased 46% in 2022 as interest rate hikes squeezed US home borrowers, according to the Consumer Financial Protection Bureau. Payments on conventional 30-year fixed-rate mortgages increased to $2,045 in December 2022 from $1,400 a year earlier, the CFPB said Wednesday in a report. The consumer watchdog annually collects and analyzes data under the Home Mortgage Disclosure Act, also known as HMDA. The trends are expected to persist this year,... Becoming a Bank Proves Challenging for Fintechs Seeking Survival22 Aug 2023—BloombergIn an era of soaring interest rates and intense competition, fintechs are increasingly deciding they need to become banks to ensure their longterm survival. They’re also finding that doing so isn’t easy. Figure Technologies Inc., a blockchain firm started by SoFi Technologies Inc. co-founder Mike Cagney, is the most recent company to withdraw its application for a bank charter, a move made after years of waiting for an answer from US financial regulators. Figure isn’t alone:...

Becoming a Bank Proves Challenging for Fintechs Seeking Survival22 Aug 2023—BloombergIn an era of soaring interest rates and intense competition, fintechs are increasingly deciding they need to become banks to ensure their longterm survival. They’re also finding that doing so isn’t easy. Figure Technologies Inc., a blockchain firm started by SoFi Technologies Inc. co-founder Mike Cagney, is the most recent company to withdraw its application for a bank charter, a move made after years of waiting for an answer from US financial regulators. Figure isn’t alone:... SoFi Surges Most in a Year After Boosting Revenue Forecast31 Jul 2023—BloombergSoFi Technologies Inc. shares rose the most in almost a year after the online bank raised its revenue guidance, citing benefits from deposit growth and lower funding costs on loans. SoFi now expects adjusted net revenue this year of $1.97 billion to $2.03 billion, up from its prior forecast of $1.96 billion to $2.02 billion, the financial-technology company said Monday. Deposits climbed as the firm avoided the problems plaguing the regional-banking industry, where a run on deposits earlier...

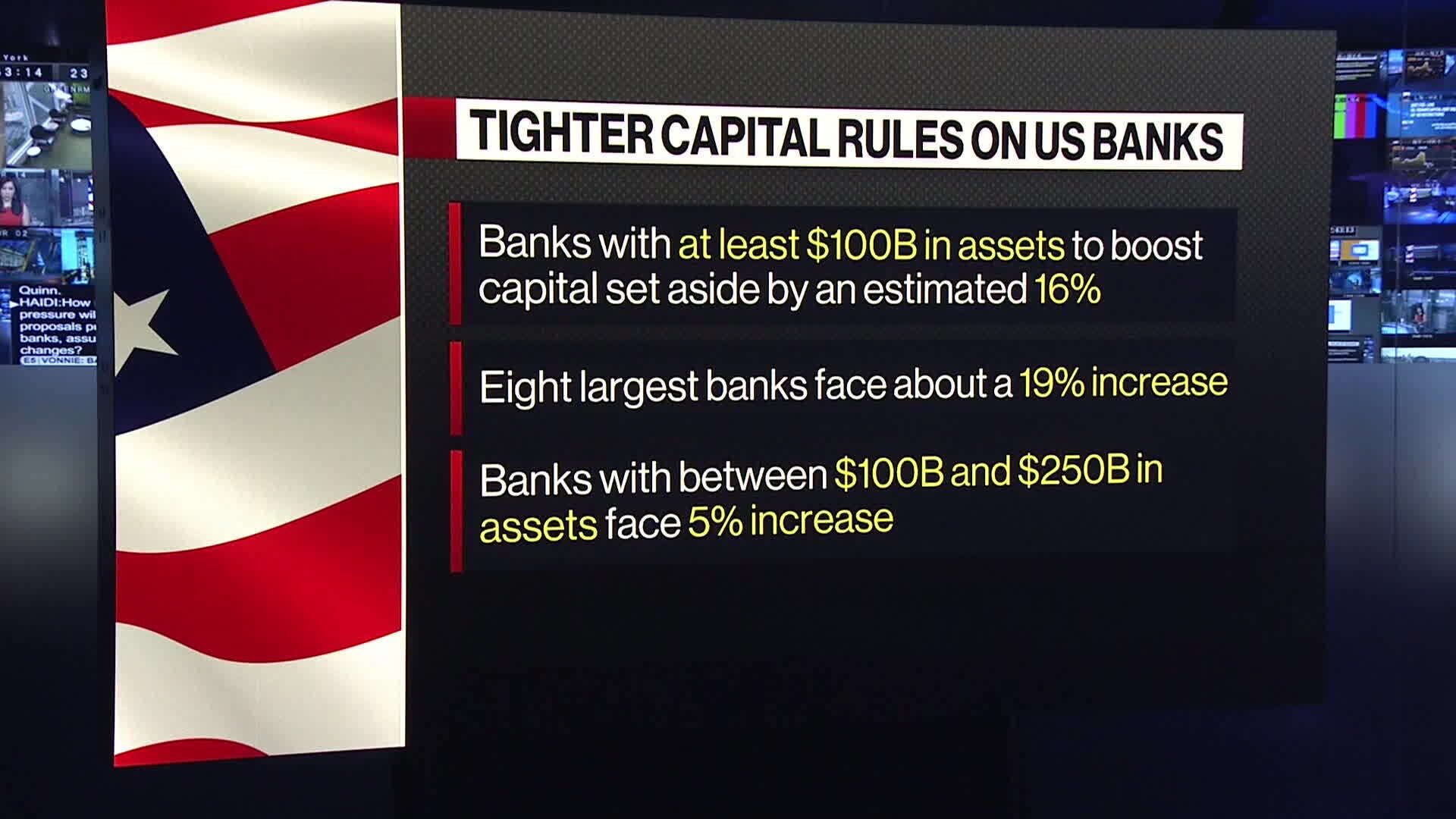

SoFi Surges Most in a Year After Boosting Revenue Forecast31 Jul 2023—BloombergSoFi Technologies Inc. shares rose the most in almost a year after the online bank raised its revenue guidance, citing benefits from deposit growth and lower funding costs on loans. SoFi now expects adjusted net revenue this year of $1.97 billion to $2.03 billion, up from its prior forecast of $1.96 billion to $2.02 billion, the financial-technology company said Monday. Deposits climbed as the firm avoided the problems plaguing the regional-banking industry, where a run on deposits earlier... Bank Capital Rules Risk Shutting Out First-Time Homebuyers27 Jul 2023—BloombergA sweeping overhaul of bank capital rules proposed by regulators includes changes to requirements for residential mortgages that will likely inflame criticism that the measures push home-ownership beyond the reach of first-time or minority borrowers. The long-awaited proposals would raise the so-called risk weights for some residential mortgages, including those with smaller down payments, meaning banks ultimately have to hold more capital against those assets. Currently in the US, a 50% risk...

Bank Capital Rules Risk Shutting Out First-Time Homebuyers27 Jul 2023—BloombergA sweeping overhaul of bank capital rules proposed by regulators includes changes to requirements for residential mortgages that will likely inflame criticism that the measures push home-ownership beyond the reach of first-time or minority borrowers. The long-awaited proposals would raise the so-called risk weights for some residential mortgages, including those with smaller down payments, meaning banks ultimately have to hold more capital against those assets. Currently in the US, a 50% risk... Fed’s New Payments Network Will Provide Boon to Fintechs, Plaid CEO Says27 Jul 2023—BloombergThe Federal Reserve’s new payments system will serve as a catalyst for financial-technology companies, which can use the network to send payments more quickly, said Plaid Inc. Chief Executive Officer Zach Perret. Last week’s introduction of FedNow will serve as a “large accelerant” for the sector, aiding processes such as paying employees, sending money to friends digitally or transferring funds from online brokerages to bank accounts, Perret said Thursday in a Bloomberg Television interview....

Fed’s New Payments Network Will Provide Boon to Fintechs, Plaid CEO Says27 Jul 2023—BloombergThe Federal Reserve’s new payments system will serve as a catalyst for financial-technology companies, which can use the network to send payments more quickly, said Plaid Inc. Chief Executive Officer Zach Perret. Last week’s introduction of FedNow will serve as a “large accelerant” for the sector, aiding processes such as paying employees, sending money to friends digitally or transferring funds from online brokerages to bank accounts, Perret said Thursday in a Bloomberg Television interview....

People Also Viewed

- JSmarketplace.org