Peter Miller

Mr. Miller is a nationally syndicated newspaper columnist and a contributor to various online sites. He is the author of seven books published by Harper & Row and has appeared on leading radio and TV outlets including Oprah!, the Today Show, CNN, and NPR.

- Pensacola, FL, USA

- @ourbroker

- in/ourbroker/

- OurBroker

Publications

- themortgagereports.com28 articles

- nrdc.org1 article

- journal-news.net1 article

- Freelance Journalist

- Nationally-syndicated newspaper real estate column

- Syndicated Real Estate Column

- Bankrate

Writes Most On

Should You Buy Carbon Offsets?11 May 2022—nrdc.orgShare this page For consumers looking to shrink their personal contribution to climate change, the opportunity to counteract the environmental cost of air travel and other fossil fuel-guzzling activities offers a dose of hope. Such is the promise of carbon offsets—a set of credits purchased from projects that are designed to reduce greenhouse gas emissions. What are carbon offsets? Offset projects encompass a range of initiatives that actively conserve forests, wetlands, and grasslands (all...

Should You Buy Carbon Offsets?11 May 2022—nrdc.orgShare this page For consumers looking to shrink their personal contribution to climate change, the opportunity to counteract the environmental cost of air travel and other fossil fuel-guzzling activities offers a dose of hope. Such is the promise of carbon offsets—a set of credits purchased from projects that are designed to reduce greenhouse gas emissions. What are carbon offsets? Offset projects encompass a range of initiatives that actively conserve forests, wetlands, and grasslands (all... FMERR 2025 guidelines and eligibility: The Freddie Mac Enhanced Relief Refinance Program15 Sep 2021—themortgagereports.comWhat is FMERR? The Freddie Mac Enhanced Relief Refinance (FMERR) is a mortgage relief program. It was created to help homeowners with little or no equity refinance into a lower interest rate and monthly payment. Fortunately, home values have been rising rapidly across the nation. And the number of homeowners with underwater mortgages has been steadily decreasing. As a result, many homeowners are refinance eligible and simply don’t know it yet. If you need a lower interest rate and cheaper...

FMERR 2025 guidelines and eligibility: The Freddie Mac Enhanced Relief Refinance Program15 Sep 2021—themortgagereports.comWhat is FMERR? The Freddie Mac Enhanced Relief Refinance (FMERR) is a mortgage relief program. It was created to help homeowners with little or no equity refinance into a lower interest rate and monthly payment. Fortunately, home values have been rising rapidly across the nation. And the number of homeowners with underwater mortgages has been steadily decreasing. As a result, many homeowners are refinance eligible and simply don’t know it yet. If you need a lower interest rate and cheaper... Investment property and second home mortgage rates in 20251 Jan 2024—themortgagereports.comAre second home mortgage rates higher? It’s a common assumption that if you have a mortgage for your primary residence (the home you live in), you might expect to get the same interest rates or loan offers on your second home. But that’s not often the case. Check your second home mortgage rates. Start here (Jan 2nd, 2025) Whether you’re buying a second home, vacation home, or investment property, it’s important to anticipate slightly higher mortgage interest rates and potentially more...

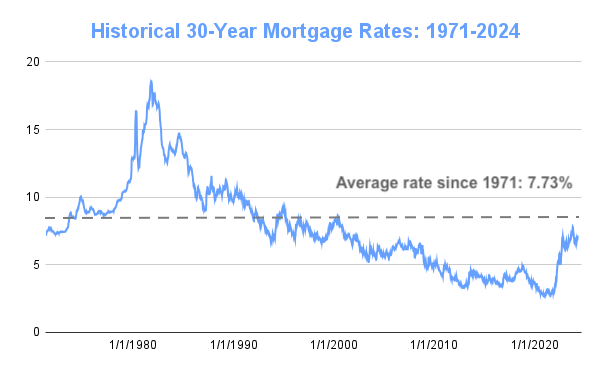

Investment property and second home mortgage rates in 20251 Jan 2024—themortgagereports.comAre second home mortgage rates higher? It’s a common assumption that if you have a mortgage for your primary residence (the home you live in), you might expect to get the same interest rates or loan offers on your second home. But that’s not often the case. Check your second home mortgage rates. Start here (Jan 2nd, 2025) Whether you’re buying a second home, vacation home, or investment property, it’s important to anticipate slightly higher mortgage interest rates and potentially more... Mortgage Rate History | Chart & Trends Over Time 20256 Dec 2024—themortgagereports.comTrends in historical mortgage rates For many homebuyers, the last few years have felt like a perfect storm of challenges—soaring home prices and climbing mortgage rates colliding to limit affordability. It’s left many wondering if 2025 will finally calm the waters. Will rates dip low enough to bring some relief, or is another wave of increases on the horizon? While there’s no magic compass to navigate these market shifts, a look back at mortgage rate history can offer clues—and maybe even...

Mortgage Rate History | Chart & Trends Over Time 20256 Dec 2024—themortgagereports.comTrends in historical mortgage rates For many homebuyers, the last few years have felt like a perfect storm of challenges—soaring home prices and climbing mortgage rates colliding to limit affordability. It’s left many wondering if 2025 will finally calm the waters. Will rates dip low enough to bring some relief, or is another wave of increases on the horizon? While there’s no magic compass to navigate these market shifts, a look back at mortgage rate history can offer clues—and maybe even...

People Also Viewed

realtor.com

realtor.com