Sabrina Willmer

Bloomberg

I report on private equity, mutual funds and hedge funds for Bloomberg News.

- Boston, Massachusetts, United States

- swillmer

Covers

Publications

- Bloomberg4 articles

Writes Most On

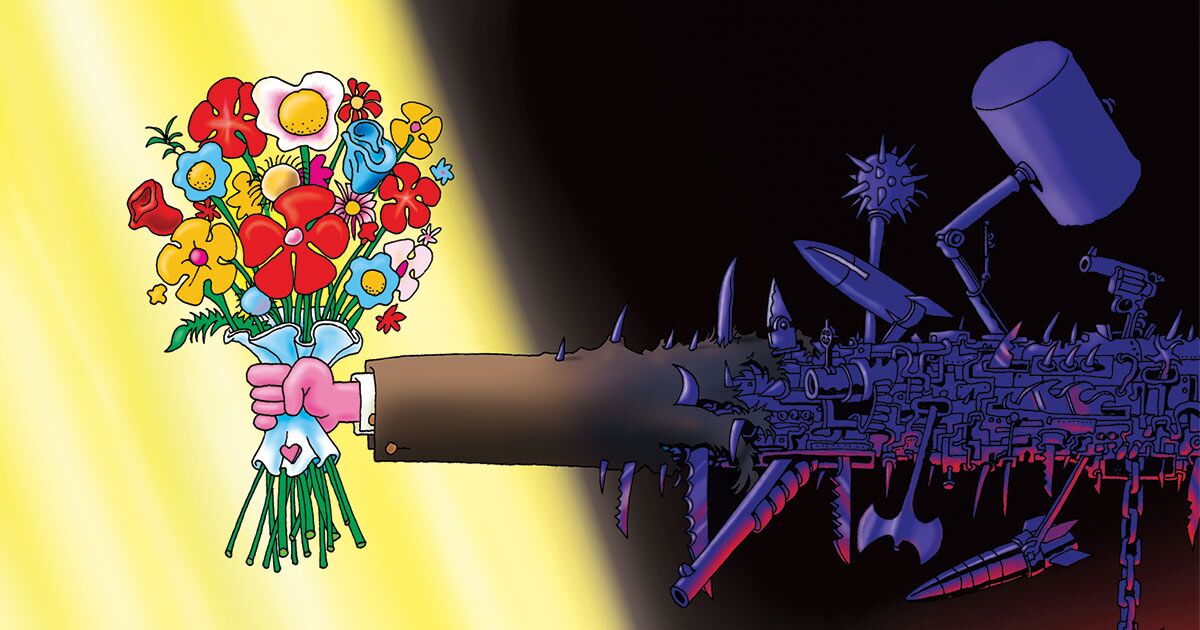

Buyout Giants Rebrand as Forces for Good While Seeking Profits4 Nov 2021—BloombergDecades after the leveraged-buyout industry rebranded itself as private equity, private equity is rebranding as the next big thing in green and socially minded money management. While some see this as a way to put a kinder, gentler face on a famously aggressive business, investors have been pouring billions of dollars into funds that aim for a positive impact beyond financial return. A record 132 “impact” funds have started this year, according to data from Preqin, which tracks the industry....

Buyout Giants Rebrand as Forces for Good While Seeking Profits4 Nov 2021—BloombergDecades after the leveraged-buyout industry rebranded itself as private equity, private equity is rebranding as the next big thing in green and socially minded money management. While some see this as a way to put a kinder, gentler face on a famously aggressive business, investors have been pouring billions of dollars into funds that aim for a positive impact beyond financial return. A record 132 “impact” funds have started this year, according to data from Preqin, which tracks the industry....- Private Equity Poised to Face a Reckoning After Gilded Decade1 May 2020—BloombergPhotographer: John Taggart/Bloomberg A turning point has arrived for the private equity industry, whose velvet-rope deals and outsized returns defined the past decade’s era of ultra-wealth on Wall Street. The jolt of the coronavirus pandemic, which halted most economic life in the U.S., has sent shockwaves through the industry, which in recent years infiltrated virtually every corner of the business world from real estate to hospitals, newspapers and restaurants. Amid the chaos, the...

BlackRock Is in Talks for a Stake in a Fintech Company4 Oct 2017—BloombergAsset manager considering investment in Capital Preferences The deal would help BlackRock expand its retail focus BlackRock Inc. is in discussions to invest in financial technology company Capital Preferences Ltd. to help bolster its focus on retail investors, according to two people with knowledge of the matter. Capital Preferences gathers data to help wealth managers understand the risk tolerance and preferences of clients, allowing firms to create portfolios suited to investors’ needs. The...

BlackRock Is in Talks for a Stake in a Fintech Company4 Oct 2017—BloombergAsset manager considering investment in Capital Preferences The deal would help BlackRock expand its retail focus BlackRock Inc. is in discussions to invest in financial technology company Capital Preferences Ltd. to help bolster its focus on retail investors, according to two people with knowledge of the matter. Capital Preferences gathers data to help wealth managers understand the risk tolerance and preferences of clients, allowing firms to create portfolios suited to investors’ needs. The... Harvard Said to Near Private Equity, Real Estate Fund Sale29 Jun 2017—BloombergUniversity seeking to unload more than $2 billion of funds Lexington Partners and Landmark Partners among the buyers Harvard University is close to reaching deals to sell private equity, venture capital and real estate holdings from its endowment as it rushes to unload more than $2 billion of assets to turn around the portfolio’s lagging performance. Harvard Management Co., which oversees the $35.7 billion endowment, is in talks with Lexington Partners for stakes in venture capital and buyout...

Harvard Said to Near Private Equity, Real Estate Fund Sale29 Jun 2017—BloombergUniversity seeking to unload more than $2 billion of funds Lexington Partners and Landmark Partners among the buyers Harvard University is close to reaching deals to sell private equity, venture capital and real estate holdings from its endowment as it rushes to unload more than $2 billion of assets to turn around the portfolio’s lagging performance. Harvard Management Co., which oversees the $35.7 billion endowment, is in talks with Lexington Partners for stakes in venture capital and buyout...

People Also Viewed

- ADForbes

- BBBloomberg