Barbara O'Neill | Source | Owner, CEO at Money Talk

Barbara O'Neill

Owner and CEO of Money Talk: Financial Planning Seminars and Publications.

I write, speak, and review existing content about personal finance topics.

Author of six books, 190+ journal articles, and 1,800+ newspaper columns and blog posts.

Distinguished Professor Emeritus at Rutgers University and a certified financial planner (R) and accredited financial counselor (R).

-

Association for Financial Counseling and Planning Education (AFCPE®)

Accredited Financial Counselor -

Annuity.org

Expert Contributor -

Money Talk (https://www.moneytalkbmo.com/)

Owner, CEO

-

4 strategies that can help you avoid paying extra every month for Medicare premiums

While most Medicare enrollees pay the standard premium amounts for Part B (outpatient care) and Part D (prescription drugs), some pay more due to higher income.

Article -

Retirement Planning: How to Prepare for Retirement

Understanding the saving and investing resources available to you will allow you to be efficient with your retirement planning.

Article

-

Expert Tips on Navigating Retirement Taxes

Dr. O’Neill explains that retirement income is taxed as ordinary income, with Social Security taxed based on income. Key changes include shifts in taxable income and spending habits. Strategies to minimize tax burdens include Roth conversions and charitable distributions. Dos include strategic withdrawals, while don’ts involve neglecting tax planning. Maximize refunds by saving or investing wisely. -

2025 IRA Rule Changes: Tax Implications and RMD Penalties

Dr. O’Neill highlights that the new 10-year withdrawal rule increases tax burdens for IRA beneficiaries, potentially raising their tax brackets. She advises planning to minimize taxes, such as naming charities as beneficiaries. Additionally, she warns of the 25% penalty for missed RMDs, which can reduce to 10% if corrected within two years. Professional advice is recommended for significant retirement assets. -

Maximize Your 401(k) Contributions in 2025: Expert Insights

Dr. O’Neill advises, "Save what you can if you can't max out your 401(k)" and scale up when possible. She emphasizes tax diversification and balancing contributions with other financial goals. Employer matching is crucial, offering "free money" and a significant return. Prioritize reaching the contribution level required to earn the maximum employer match.

-

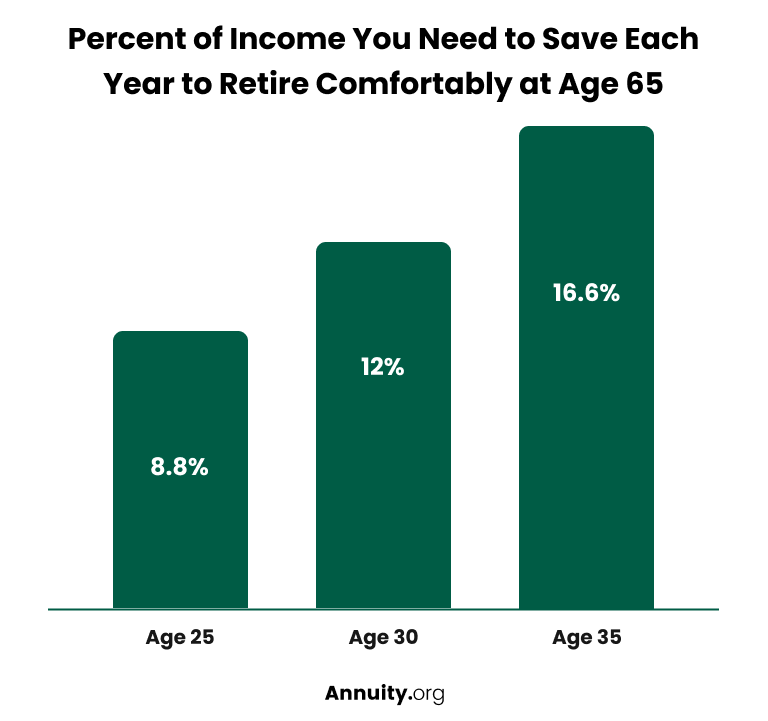

Retirement planning is a process that, ideally, lasts for decades from your first early career retirement plan contribution to savings withdrawals in later life. Some people get a late start to saving and may need to make trade-offs such as downsizing, retiring later or working during retirement. Take advantage of online financial calculators and government resources to develop a personalized retirement plan.

-

With mutual funds, you don’t have a whole lot of control because they have to pass the gains on to you. The problem is you don’t know how big those distributions are going to be until very late in the tax year.