Frank Lietke | Source | executive director and president of Ally Invest Securities at Ally Financial

Frank Lietke

Frank Lietke was named Executive Director and President of Ally Invest Securities in August 2021. In this current role, he is responsible for all aspects of Ally’s securities brokerage.

Lietke has spent his entire professional career with Ally. He began his career in 2008 as a financial analyst for Ally’s Global Automotive Services. During his tenure, he has served in various Treasury and Finance roles, including Treasury Director for Ally’s businesses before being named Finance Director of Ally Invest in 2016. His experience includes leading the collaboration of cross-functional business partners to execute on both business priorities and growth. Before taking on his current role, Lietke led business development, product management and strategy for Ally Invest. Lietke keeps a close eye on how the economy and markets impact consumers' wallets, and his commentary has been featured in national news publications including The Washington Post, Bloomberg, CNN, Kiplinger and more.

Lietke has a bachelor’s degree in finance and economics from Wayne State University, and an MBA from Michigan State University. Additionally, he earned a certificate in behavioral finance from UCLA and holds Series SIE, 7 and 24 licenses from FINRA. Lietke is a passionate advocate for his community, volunteering with the Leukemia & Lymphoma Society, donating his time as a mentor to various local organizations and coaching youth football, basketball and baseball. Lietke currently resides in Charlotte with his wife and three kids.

-

Ally Financial

executive director and president of Ally Invest Securities

-

The Washington Post: 4 takeaways for your wallet following the Fed rate pause

With the Federal Reserve signaling more rate increases to come, you might want to go ahead and make that major purchase.

Article -

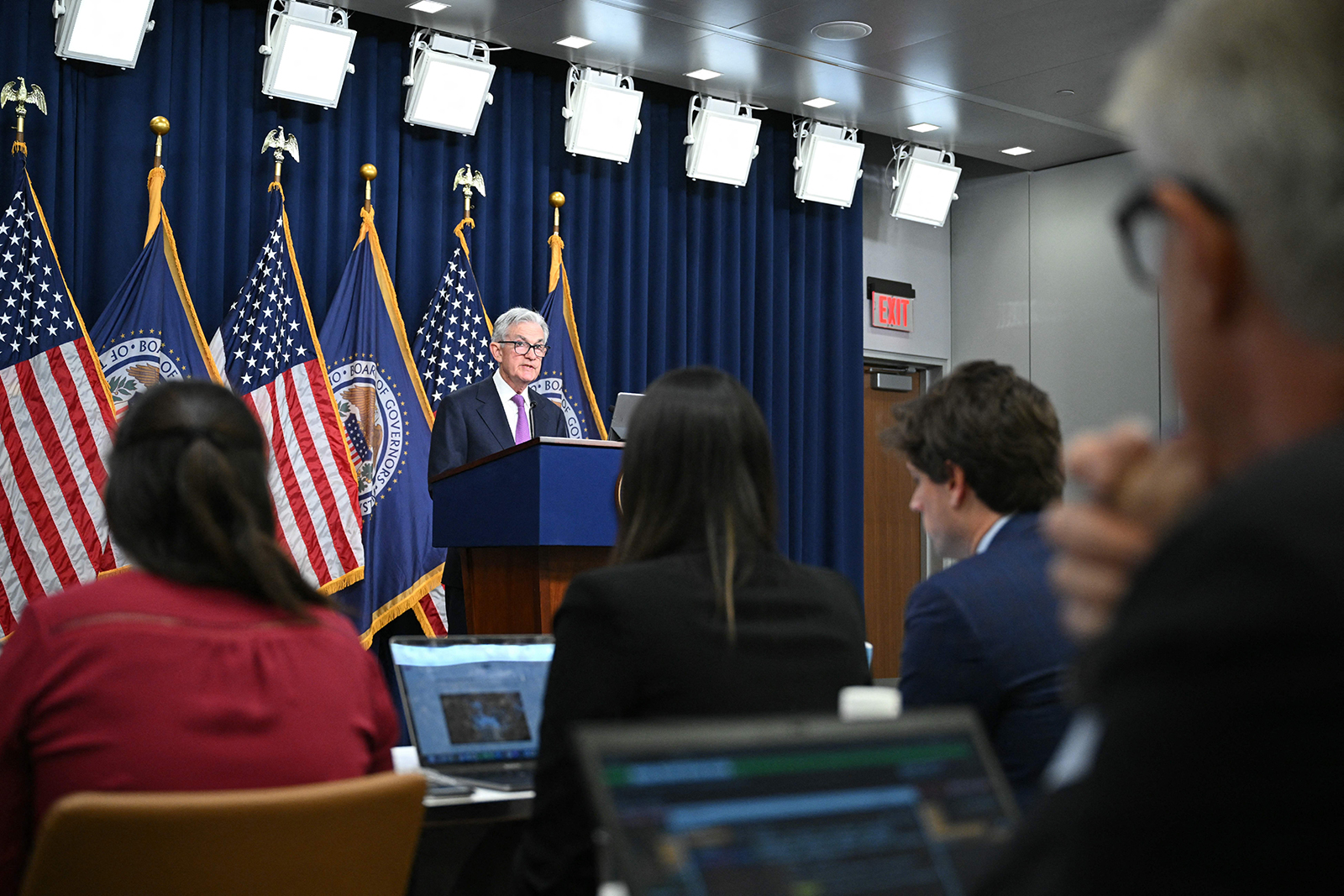

CNN: Powell attempts to keep all options on the table

Federal Reserve Chair Jerome Powell is trying to have his cake and eat it too.

Article -

Kiplinger: Fed Leaves Interest Rates Unchanged: What the Experts Are Saying

The Fed hit the pause button again but still sees rates staying higher for longer.

Article

-

Markets will take some time to digest the news,” said Frank Lietke, executive director and president at Ally Invest Securities. However, he said he doesn’t expect the credit rating downgrade to cause the stock market much long-term damage. “We’ve seen this before,” Lietke said. “This alone won’t be enough to put significant downward pressure on stocks.” - MarketWatch

"We should remain vigilant — strategic planning, differentiating between essential and non-essential expenses, and making smart decisions today can help consumers weather a potential recessionary storm.” - Kiplinger

“A resilient US economy and high consumer spending over the next several months will likely prompt the Fed to raise rates again heading into the new year." - CNN