Jamie Anderson | Source | Head of US Trading at Insight Investment

Jamie Anderson

Jamie joined Insight in January 2015 as Head of US Trading, with experience in the trading of cash, derivatives, futures and options. Prior to Insight, he spent six years at Bank of New York Mellon where he was a managing director principally focused on interest rate derivative trading and later served as Head of Global USD Rates Trading. Jamie has also held a derivatives trading position at Countrywide Financial and started his career in 2000 as a derivatives trader at Wells Fargo. Jamie holds a BArtsSc in Economics from McMaster University, Ontario, Canada and an MA in Economics from Queen’s University, Ontario, Canada. As well as holding Series 7, 63 and 24 licenses from the Financial Industry Regulatory Authority (FINRA), Jamie is also a CFA charterholder.

-

Insight Investment (https://www.insightinvestment.com/)

Head of US Trading

-

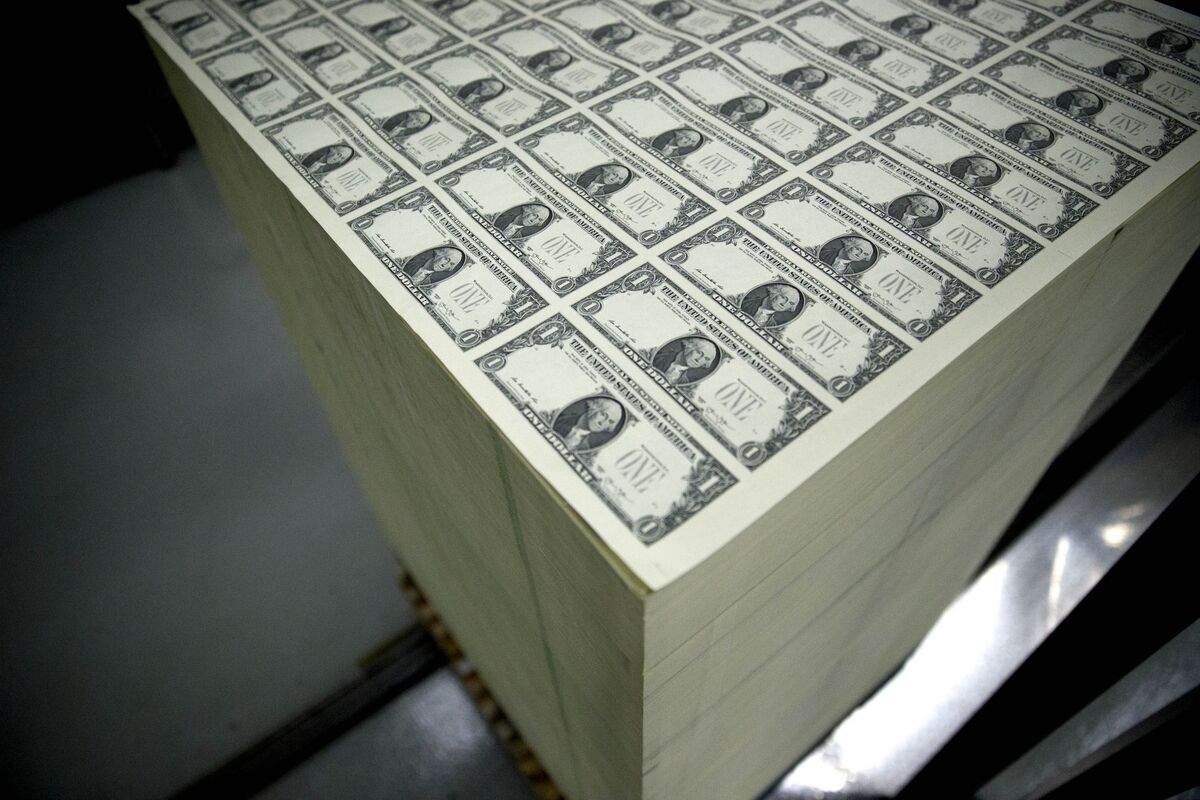

Dizzied Bond Traders Brace for More Pain as Fed Speakers Line Up

The past week’s tumult in the $21 trillion Treasuries market has left shell-shocked traders positioned for even more losses ahead -- raising pressure on Federal Reserve officials to respond to the startling run-up in yields.

Article -

Bond Market’s ‘Game of Chicken’ With Fed Is Set for a Reckoning

Investors are again reassessing one of the bond market’s premier reflation trades -- the curve steepener -- as expectations for growth and inflation perk up at a clip that was hard to imagine just a few months ago.

Article

-

Further turbulence is possible amid a large amount of crosscurrents that are pushing different parts of the rates market.

-

It’s possible the market may have gotten a little ahead of itself in the belly.