Jarrett Lilien | Source | President and Chief Operating Officer at WisdomTree

Jarrett Lilien

Jarrett Lilien has served as President and Chief Operating Officer of WisdomTree Investments, Inc. since September 2019. From November 2017 to September 2019, he served as Executive Vice President and Head of Emerging Technologies. Prior to joining the executive management team, Mr. Lilien served on WisdomTree’s Board of Directors from November 2008 to December 2017.

Until his most recent role, Mr. Lilien was the Managing Partner of Bendigo Partners, LLC, a financial services-focused venture capital investing and advisory services firm he founded in 2008. From September 2012 to July 2014, Mr. Lilien served as the Chief Executive Officer of Kapitall Inc., an online investing platform. From 2003 to 2008, he served as President and Chief Operating Officer of E*TRADE Financial Corporation and earlier as President and Chief Brokerage Officer of subsidiary E*TRADE Securities. Prior to joining E*TRADE, Mr. Lilien spent 10 years as Chief Executive Officer at TIR (Holdings) Limited, a global institutional broker, which E*TRADE acquired in 1999.

Mr. Lilien currently serves as a Chairman of the Jazz Foundation of America and is on the Boards of Directors of Barton Mines Corporation and the Baryshnikov Arts Center. He previously served on the Board of Directors of ITG (NYSE: ITG), an independent execution broker and research provider, and served as interim CEO from August 2015 until January 2016. Since November 2017, Mr. Lilien also has served on the Board of Directors of AdvisorEngine Inc., an innovative financial technology company in which WisdomTree originally invested in November 2016. Mr. Lilien received his B.A. in Economics from the University of Vermont.

-

WisdomTree (https://www.wisdomtree.com/)

President and Chief Operating Officer

started Sep 2019

-

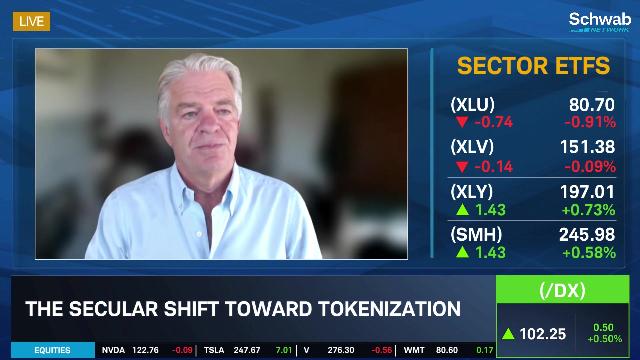

WisdomTree Connect's Tokenization of Crypto & Tech Stocks | Schwab Network

Jarrett Lilien, President of Wisdom Tree Investments, talks about the company's new WisdomTree Connect platform and its process of tokenizing assets. He calls it a better alternative to ETFs because it offers investors more liquidity and transparency. Jarrett talks about how it works for cryptocurrencies like Bitcoin and Ethereum.</p>

Video -

WisdomTree Aims to Become Asset Management ‘Gorilla’ - Markets Media

WisdomTree's total assets under management crossed $100bn in December 2023.

Article

-

“We have been a leader in ETFs for 17 years, but we weren’t the first to the ETF party. This meant that when we came to the market we had to innovate, because all the big beta exposures, like the S&P, were already taken.” – Markets Media

-

“If you're going to be competitive and with the times, you're open architecture, and you'll have a combination of your own product and other firms' products.” – Ignites