Rhian Horgan | Source | Founder and CEO at Kindur

Rhian Horgan

-

Silvur

Founder and CEO -

Kindur

Founder and CEO

started Sep 2016 -

JPMorgan Chase & Co.

International Head of Alternative Investments, Global Wealth Management, Managin

Jun 2010 – Jul 2014

-

Katie Couric Media Partners With Silvur to Support Women’s Financial Health

Silvur, the country’s only financial fitness platform helping adults over 50 take control of their financial future, just announced a content partners

Article -

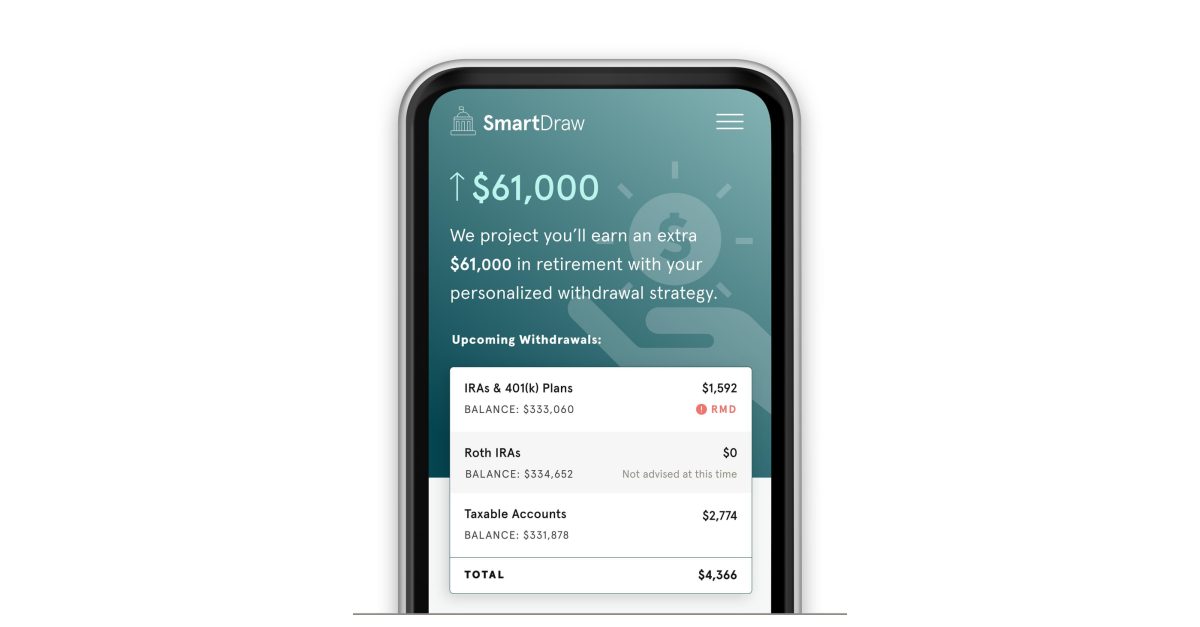

Kindur Introduces SmartDraw, New Subscription Service to Help Baby Boomers Keep More of Their Money in Retirement

Today, Kindur has officially launched SmartDraw, a subscription service designed to empower baby boomers to retire fearlessly. With Kindur’s intuitive

Article -

Startup founder: Why retirement funding is 'completely different' from year's past

As preparing for retirement becomes an increasingly complicated picture for Americans, this startup is promising Baby Boomers a peace of mind while sorting out their financial future.

Article

-

Everyone should feel like they can tackle new adventures at any stage of their lives. Katie is the perfect example of an ageless woman who is fearless and pursuing new adventures with confidence. We want all women -- single, married, divorced, or widowed -- to have the power that comes with understanding your financial situation.

-

What's challenging for this generation of boomers is their retirement looks completely different than their parents. So when they started saving, they weren't expecting to live 30 years at retirement. They were probably expecting to live 15 or 20 years. And they also weren't expecting to spend $280,000 on health care over the course of retirement.

-

Millions of Americans transitioning out of the workforce face a web of new tax codes, regulations and deadlines with high-consequence penalties. Even for individuals who’ve done well managing their finances throughout their working lives, today’s retirement is completely different than any other generation has faced and requires a new approach.